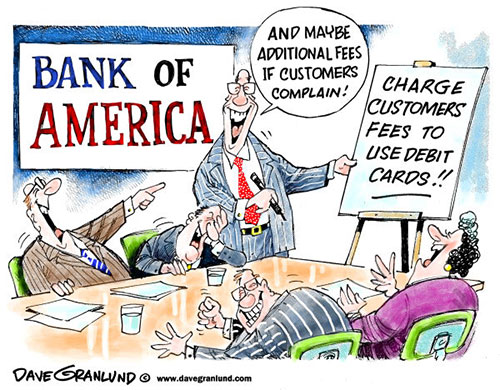

It’s surely a long accepted fact that banks are pretty much evil? They caused the global economic crisis then held their hands out and demanded huge bailouts without showing a hint of shame, regret, humility or even embarrassment. Who among us hasn’t felt at least a little screwed by a bank at least once? If only we could charge them dumb fees like they charge us, right? Well, I think we can, in fact I have, and they’ve paid!

I’ve not lived in the UK now for some years, but I still have a UK bank account just because it’s handy. I use Smile, the internet bank of the Co-op. I chose them because out of the collection of slippery not-to-be-trusted UK banks to choose from, they seemed like the least evil.

Truthfully, if I had planned my exit from dreary shores of the United Kingdom a little better, I would have picked another bank, one whose overseas card usage and currency conversion charges weren’t as objectionable, but I’m rather stuck with them now.

Over the years since I’ve left Smile have given me little reason to smile at all. Banking isn’t exactly something any ordinary person finds reason to look happy about. Dealing with your bank is rather like dealing with your need to use a toilet. It’s just a fact of life and there’s no need to dwell on it, so to speak.

I travel a great deal, and I’ve managed to train my bank not to constantly block my cards, which they have done many times, sometimes leaving me in really quite awkward situations. However, my recent arrival in India set off some program somewhere that immediately stopped my bank card.

I travel a great deal, and I’ve managed to train my bank not to constantly block my cards, which they have done many times, sometimes leaving me in really quite awkward situations. However, my recent arrival in India set off some program somewhere that immediately stopped my bank card.

Now I know, this is hardly the end of the world, but its annoying a time consuming to remedy, especially since I had gone to the trouble of writing to them informing them of my travel itinerary and I had also called them prior to my departure.

So this time I did what I’ve taken to doing with companies that levy charges against their customers. I charged them!

In a secure message I informed the bank that they were already aware of my travel arrangements, and as such I would be charging them a £25.41 inconvenience fee.

This is not the first time I have done this. I’ve charged my car insurance a processing fee for when they made me refill a form I had already done, I charged my gas supply company rent for putting their gas meter in my living room, and I charged another bank a handling fee after they deposited a large sum of money in my account by accident some year ago.

They all paid! To be clear, not one of them accepted the charge. However, all of them made a ‘gesture of goodwill’ to the same amount, or very close to the amount, of my fee.

I even called out Qantus for their ‘convenience fee’ when I paid online for a flight using a card. This was in addition to the already high card processing fee! It was the only way I could pay, so it wasn’t like there was a more inconvenient choice for me. I pushed them on this and they simply dropped the fee.

Why should bank charges be a one way street. Not long ago I stood in line at my bank in Melbourne, the single bank teller was having a friendly conversation with the lady at the counter while others stood anxiously in line anxiously watching their lunch hour slide away into that bottomless pit of admin.

As I stood there I pondered for a moment what might happen if everyone in line charged the bank for their time in the same way the bank often charge for a ‘counter service.’ When the teller told me there would be a $6 counter service fee I told him that my fifteen minute wait was chargeable. He looked at me and laughed, then waived the fee, “this time.”

So while this might not be the most interesting blog post ever, I just wanted to use this platform to encourage you to apply a fee to your bank, insurance company, or whatever greedy organisation causes you to have to go out of your way to address something. Its your money were talking about, you might as well try!

4 Responses to “MAKE THEM PAY!”

Post a comment

If you have an opinion about this post, then share it! [More about comments]

Wrote the following comment on Jun 24, 2015 at 3:30 pm

Pretty funny idea. I read this then found myself going through my day wondering what was chargeable. Standing on line at Starbucks, talking to someone on the phone about my cable service. I felt sure I should be earning something for my work at the self checkout at the grocery store this evening! Haha!

Wrote the following comment on Jun 25, 2015 at 10:35 am

@ Raj – How about self check-in at the airport? The list could go on and on! :-)

Wrote the following comment on Nov 25, 2015 at 1:46 pm

Wonderful idea, Simon. I’ll be trying this in future with larger corporations for sure.

Wrote the following comment on Nov 25, 2015 at 9:22 pm

Hi Theresa. It’s a little embarrassing how dusty and deserted my blog is these days. At the third of the new year I made grand plans to post at least once a week, but here it is, unused, unloved perhaps, gathering digital dust.

This post was published and then somehow marked as private days later and I didn’t even notice until the other day. Geez! But hey, still nice to know when I made it public again someone noticed. :)

I should write something. I like to write. I’m in Patis at the moment and I’ve got stuff to say, so perhaps today I’ll find a cafe and write. But I’ve so many other things to do! Ugh!

No you know what, those other things are work stuff that don’t really excite me. So yes, today I will write! Thanks for popping by Theresa!

Oh and as for my idea being ‘wonderful,’ come on, lets not give it too much fanfare. It’s merely an idea worth a try/ We’re talking bank charges here, lets save wonderful for things that deserve that term :-)